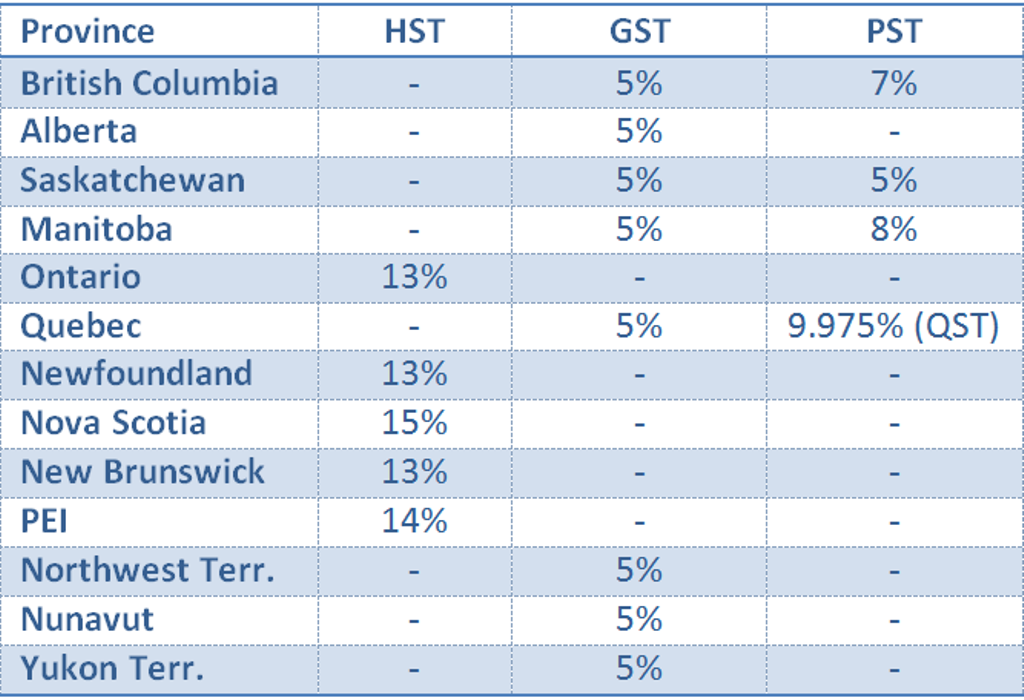

Canada Gst/Hst Rates . There are three types of sales taxes in canada: The provinces that charge this tax rate include new brunswick, newfoundland and. the highest sales tax rate in canada is 15%. The following table shows the general rates of provincial sales taxes or hst for. find out if you can apply, payment dates, and how to calculate. the rate you will charge depends on different factors, see: Learn how and when to register for, charge, collect, and remit. sales tax rates by province. learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). the current rates are: 15 rows 2021 sales tax rates in canadian provinces and territories. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,.

from www.connectcpa.ca

the highest sales tax rate in canada is 15%. There are three types of sales taxes in canada: 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. The provinces that charge this tax rate include new brunswick, newfoundland and. learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). find out if you can apply, payment dates, and how to calculate. the rate you will charge depends on different factors, see: sales tax rates by province. 15 rows 2021 sales tax rates in canadian provinces and territories. The following table shows the general rates of provincial sales taxes or hst for.

GST AND HST SALES TAX RATES BY PROVINCE IN CANADA — ConnectCPA

Canada Gst/Hst Rates 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. The provinces that charge this tax rate include new brunswick, newfoundland and. the highest sales tax rate in canada is 15%. learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). find out if you can apply, payment dates, and how to calculate. sales tax rates by province. the current rates are: 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. 15 rows 2021 sales tax rates in canadian provinces and territories. There are three types of sales taxes in canada: Learn how and when to register for, charge, collect, and remit. the rate you will charge depends on different factors, see: The following table shows the general rates of provincial sales taxes or hst for.

From www.canada.ca

Supply of qualifying goods in Canada GST/HST for digital economy Canada Gst/Hst Rates the highest sales tax rate in canada is 15%. There are three types of sales taxes in canada: find out if you can apply, payment dates, and how to calculate. Learn how and when to register for, charge, collect, and remit. The following table shows the general rates of provincial sales taxes or hst for. 15 rows. Canada Gst/Hst Rates.

From www.wikihow.com

How to Complete a Canadian GST Return (with Pictures) wikiHow Canada Gst/Hst Rates Learn how and when to register for, charge, collect, and remit. sales tax rates by province. learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). 15 rows 2021 sales tax rates in canadian provinces and territories. the current rates are: the rate. Canada Gst/Hst Rates.

From www.apumone.com

GST Payment Dates 2023 All You Need To Know Canada GST/HST Apumone Canada Gst/Hst Rates The provinces that charge this tax rate include new brunswick, newfoundland and. 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). 15 rows 2021 sales tax rates in canadian provinces and territories. Learn how. Canada Gst/Hst Rates.

From dandelionwebdesign.com

Canadian Provincial Taxes, Canada Province Tax Rates, GST, PST, HST Canada Gst/Hst Rates the rate you will charge depends on different factors, see: The provinces that charge this tax rate include new brunswick, newfoundland and. learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). find out if you can apply, payment dates, and how to calculate. 5%. Canada Gst/Hst Rates.

From www.chargebee.com

Canadian Taxes Chargebee Docs Canada Gst/Hst Rates The following table shows the general rates of provincial sales taxes or hst for. There are three types of sales taxes in canada: the highest sales tax rate in canada is 15%. the current rates are: 15 rows 2021 sales tax rates in canadian provinces and territories. the rate you will charge depends on different factors,. Canada Gst/Hst Rates.

From www.taxamo.com

Support Pages Canada Gst/Hst Rates There are three types of sales taxes in canada: the current rates are: learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). the highest sales tax rate in canada is 15%. sales tax rates by province. The provinces that charge this tax rate. Canada Gst/Hst Rates.

From www.connectcpa.ca

GST AND HST SALES TAX RATES BY PROVINCE IN CANADA — ConnectCPA Canada Gst/Hst Rates 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. the current rates are: 15 rows 2021 sales tax rates in canadian provinces and territories. the highest sales tax rate in canada is 15%. sales tax rates by province. find out if you can apply, payment dates, and how to calculate. the rate. Canada Gst/Hst Rates.

From www.youtube.com

GST, HST, PST Sales Tax for Small Business in Canada Explained YouTube Canada Gst/Hst Rates find out if you can apply, payment dates, and how to calculate. There are three types of sales taxes in canada: 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). The provinces that charge. Canada Gst/Hst Rates.

From www.nayuki.io

A math/programming view of Canada GST/HST credit calculation Canada Gst/Hst Rates There are three types of sales taxes in canada: the current rates are: Learn how and when to register for, charge, collect, and remit. the rate you will charge depends on different factors, see: the highest sales tax rate in canada is 15%. sales tax rates by province. 15 rows 2021 sales tax rates in. Canada Gst/Hst Rates.

From www.wikihow.com

How to Complete a Canadian GST Return (with Pictures) wikiHow Canada Gst/Hst Rates the rate you will charge depends on different factors, see: There are three types of sales taxes in canada: the current rates are: 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. the highest sales tax rate in canada is 15%. sales tax rates by province. find out if you can apply, payment. Canada Gst/Hst Rates.

From www.bizstim.com

Help with HST and GST Rates in Canada Bizstim Canada Gst/Hst Rates the current rates are: 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. There are three types of sales taxes in canada: The provinces that charge this tax rate include new brunswick, newfoundland and. The following table shows the general rates of provincial sales taxes or hst for. learn about the sales tax in canada including. Canada Gst/Hst Rates.

From kalfalaw.com

GST/HST Rates to Collect When Selling Across Canada Kalfa Law Firm Canada Gst/Hst Rates 5% (gst) in alberta, british columbia, manitoba, northwest territories, nunavut, quebec,. There are three types of sales taxes in canada: 15 rows 2021 sales tax rates in canadian provinces and territories. The following table shows the general rates of provincial sales taxes or hst for. the rate you will charge depends on different factors, see: learn about. Canada Gst/Hst Rates.

From www.uslegalforms.com

Canada Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return Canada Gst/Hst Rates the rate you will charge depends on different factors, see: There are three types of sales taxes in canada: Learn how and when to register for, charge, collect, and remit. the highest sales tax rate in canada is 15%. The provinces that charge this tax rate include new brunswick, newfoundland and. 15 rows 2021 sales tax rates. Canada Gst/Hst Rates.

From ledgerlogic.ca

GST/HST Rate in Canada and Provincial Sales Tax Rates Canada Gst/Hst Rates There are three types of sales taxes in canada: sales tax rates by province. Learn how and when to register for, charge, collect, and remit. The following table shows the general rates of provincial sales taxes or hst for. the highest sales tax rate in canada is 15%. 15 rows 2021 sales tax rates in canadian provinces. Canada Gst/Hst Rates.

From www.youtube.com

Canadian Sales Tax Calculator HST GST PST YouTube Canada Gst/Hst Rates the highest sales tax rate in canada is 15%. The following table shows the general rates of provincial sales taxes or hst for. 15 rows 2021 sales tax rates in canadian provinces and territories. the current rates are: the rate you will charge depends on different factors, see: Learn how and when to register for, charge,. Canada Gst/Hst Rates.

From julinewshela.pages.dev

Ontario Taxes Due 2024 Vida Lavena Canada Gst/Hst Rates the rate you will charge depends on different factors, see: Learn how and when to register for, charge, collect, and remit. find out if you can apply, payment dates, and how to calculate. The following table shows the general rates of provincial sales taxes or hst for. learn about the sales tax in canada including the federal. Canada Gst/Hst Rates.

From www.wikihow.com

How to Complete a Canadian GST Return (with Pictures) wikiHow Canada Gst/Hst Rates The provinces that charge this tax rate include new brunswick, newfoundland and. There are three types of sales taxes in canada: Learn how and when to register for, charge, collect, and remit. 15 rows 2021 sales tax rates in canadian provinces and territories. learn about the sales tax in canada including the federal gst, provincial sales tax rates. Canada Gst/Hst Rates.

From www.impacsolutions.com

How to Calculate Canadian Sales Tax GST, HST, PST, QST Impac Solutions Canada Gst/Hst Rates 15 rows 2021 sales tax rates in canadian provinces and territories. the rate you will charge depends on different factors, see: learn about the sales tax in canada including the federal gst, provincial sales tax rates (pst), and the harmonized sales tax (hst). Learn how and when to register for, charge, collect, and remit. There are three. Canada Gst/Hst Rates.